TiO2 market analysis and price trend

NOTE: Please click here for full details on the criteria ICIS pricing uses in making these price assessments.

COPYRIGHTS: This article was shared to tio2.info by anonymous industrial expert for public reading. The original text was edited by Deniz Koray, Heidi Finch, Joson Ng, which was posted on ICIC at 24th Sep.2021. If this sharing is a infringement, please click to contact us.

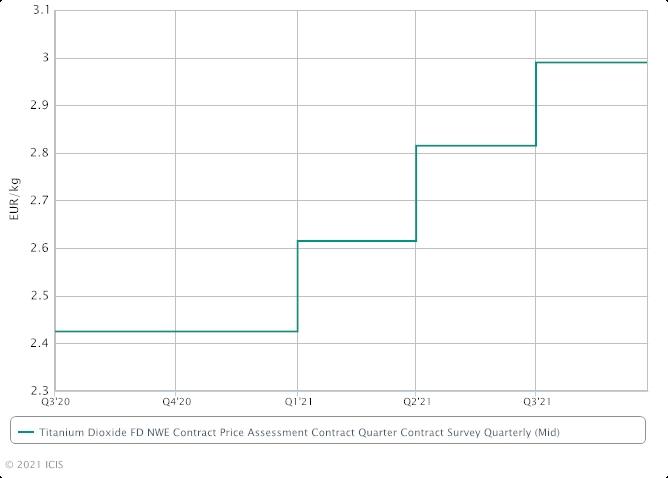

EUROPE CONTRACT PRICE

Table-EUROPE CONTRACT PRICE

| Price range | One year ago | US CTS/lb | ||||

|---|---|---|---|---|---|---|

| FD NWE Q3 | EUR/kg | +0.15 | 2.80-3.18 | +0.20 | 2.20-2.65 | 148.79-168.98 |

Overview

- Sentiment firmer for Q4

- Europe supply continues to face various pulls

- Buying momentum strong in construction, furniture segments

Europe titanium dioxide (TiO2) contract price discussions are heard atypically firmer for Q4 - contrary to usual low season expectations during the winter - as domestic demand continues to exceed supply, compounded by the disrupted and uncompetitive Chinese import flow. Feedstock supply strain and recent and current TiO2 output disruptions have also impacted availability.

Outlook

- Winter weather could impact construction in Q4; backlogs, supply concerns could offset this

- Supply tightness to persist amid various pulls

- Upstream supply tension could last at least for next few years

Prices

Europe TiO2 price increases of €120-150/tonne and up to €200-250/tonne for Q4 have been heard separately mooted by western suppliers amid a tight and buoyant market, which faces various persistent pulls on supply, including an ongoing lack of Chinese export competitiveness. Discussions are underway.

Fresh buying interest for Asian spot cargo was limited in the trade sector this week, although logistical bottlenecks and the strict carbon controls on production/supply in China were being closely monitored.

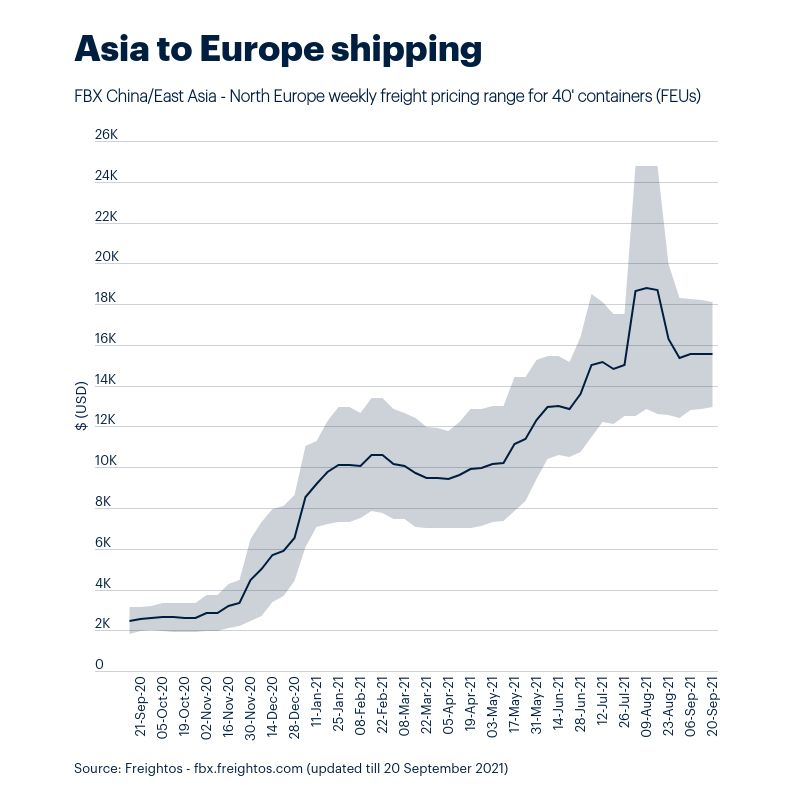

Supply remains tense, with allocations still in place for western product and no option to secure volumes outside of this. Lead times have been extended, especially for Chinese import product, because of the ongoing deep-sea logistics crisis. The lack of Chinese import competitiveness, stricter Chinese energy-saving measures and heightened shipping uncertainty are triggering more domestic over Asian import sourcing. Other import volumes are also believed to be significantly delayed, further pressuring European supply.

Demand in Europe remains robust overall and continues to outpace supply. The construction and furniture segments continue to perform strongly. While there may be some seasonal slowdown in the construction segment in Q4 during the winter - depending on the weather conditions - this could be offset by backlog orders and supply concerns, which could support continued buying activity.

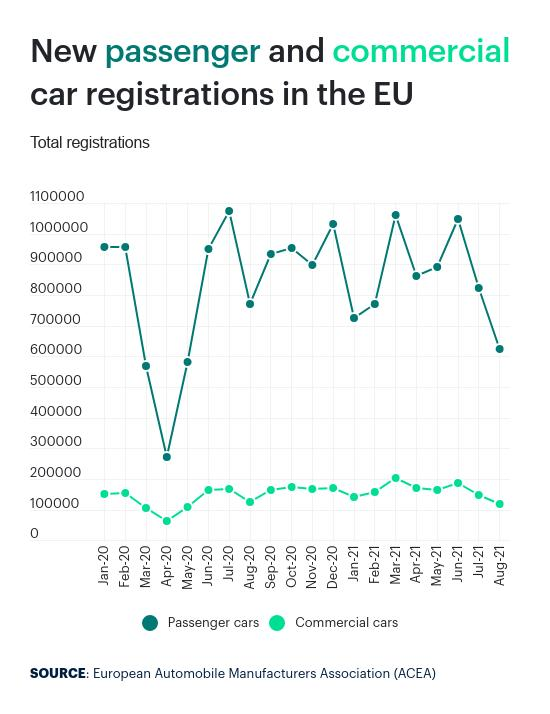

Demand from the advertising sector is good, as events have re-opened as coronavirus restrictions have eased. While various product shortages such as microchips, polyvinyl chloride (PVC) or additives may be capping demand for TiO2 in some sectors such as auto, this is not having an impact on overall TiO2 demand so far. Strained feedstock supply and a few TiO2 output impacts, including Tronox’s force majeure at Stallingborough, are also limiting TiO2 availability.

Production

There is ongoing market talk that Tronox may still be experiencing production and supply disruption, although the company has not provided any comment on this at the time of writing. Tronox declared a force majeure on its TiO2 supply from its Stallingborough site in mid-July, due to production impacts.

There is no further official update available on the status of Rio Tinto’s ramp-up/operations or force majeure at its Richards Bay Mineral (RBM) mine in South Africa, which restarted on 24 August following some forced downtime, linked to local tensions.

Analytics

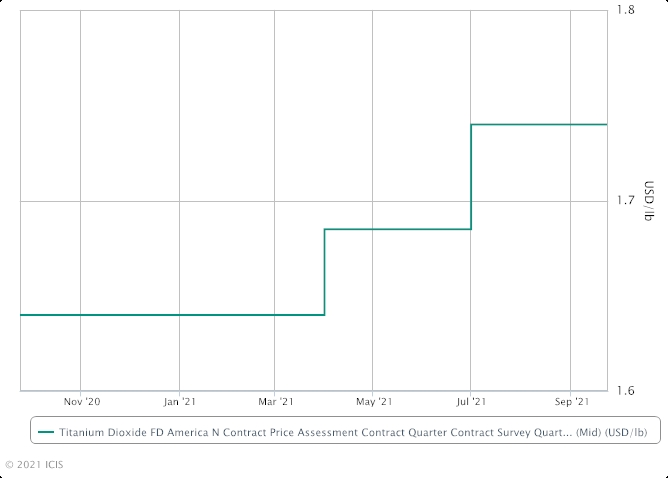

Table-US CONTRACT PRICE

| Price range | One year ago | US CTS/lb | ||||

|---|---|---|---|---|---|---|

| FD N America Q3 | USD/lb | +0.06 | 1.69-1.79 | +0.05 | 1.58-1.70 | 169-179 |

Overview

- More price increase proposals heard as Q4 approaches

- Demand remains strong from construction sector

- Limited material availability; spot market talks pick up

Two more price increase initiatives were heard from market sources but have not yet been verified. The separate price increase proposals were in the range of 7-8 cents/lb, with early October implementation dates.

Potential price increase talks have picked up in recent weeks, and several agreements for Q4 have been heard. However, this reflects only a segment of the marketplace and discussions are ongoing.

Thus far, some players commented that there was pushback from buyers on the proposed price increases, but there were limits on their leverage due to strong demand. Supply is still constrained in the US, especially for buyers on the spot market, as well as for contract buyers seeking to buy beyond their allocations.

Outlook

- Demand expected to stay strong into Q4

- Iluka expected to suspend operations in Sierra Leone in two months

- Private equity offer for Tronox to be monitored

Prices

The price chart below shows US quarterly contract pricing over the past year.

Price Increase Announcements

This week, two more price increase nominations for Q4 were heard although they could not be fully verified.

Thus far separate price increase proposals from Kronos and Tronox have been seen although the companies did not provide comment on the initiatives.

Demand remains strong for TiO2 because of changing consumption patterns that have led to an increase in the usage of white pigment. This includes greater demand from end users making bathtubs, showers, and boats.

Due to both stronger demand and supply constraints, buyers are seeking to procure material beyond their contractual allocations, which is leading to greater spot market activity. However, spot market prices have been heard to be 30-40 cents/lb higher than contracts in some instances.

However, transactions at these higher levels have been heard because demand has been strong enough to support it.

The announcements in the table below are for TiO2 produced through the chloride process.

Table-Price increase announcements

| Producer | Cents/lb | Effective date | Region |

|---|---|---|---|

| Kronos | 5 | 1 January | North America |

| Tronox | 5 | 1 February | Americas |

| Venator | 6 | 1 January | Americas |

| Venator | 8 | 1 April | Americas |

| Kronos | 5 | 1 April | North America |

| Tronox | 6 | 1 July | Americas |

| Venator | 8 | 1 July | North America |

| Kronos | 5 | 1 July | North America |

| Tronox | 5 | 1 October | North America |

| Kronos | 8 | 1 October | North America |

Due to price protection agreements, some of these price increases are not implemented for 60-to-90 days, even after buyers have agreed to higher prices.

Downstream

Economic Indicators

US August housing starts rise 3.9%, but single family starts fall 2.8%

US home builder confidence rises amid lower lumber costs, strong demand

Global 2021 GDP growth revised lower to 6.0% from 6.3% amid supply bottlenecks - Fitch

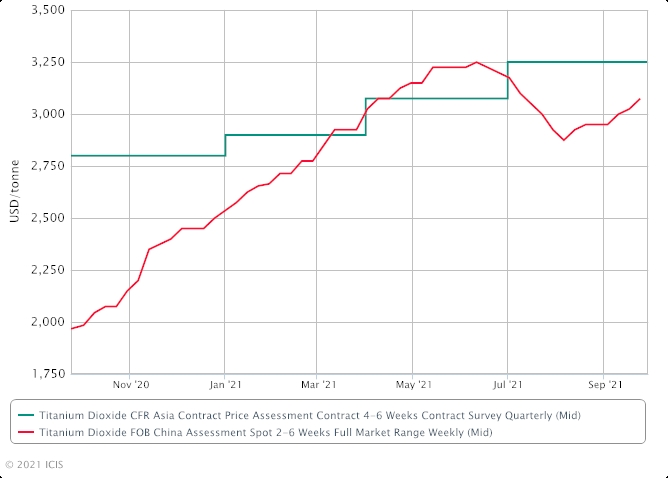

Table-ASIA CONTRACT PRICE

| Price range | One year ago | US CTS/lb | ||||

|---|---|---|---|---|---|---|

| CFR Asia Q3 | USD/tonne | +200 | 3150-3350 | +150 | 2700-2900 | 142.88-151.95 |

Table-ASIA SPOT PRICE

| Price range | One year ago | US CTS/lb | ||||

|---|---|---|---|---|---|---|

| FOB China Q3 | USD/tonne | +50 | 3050-3100 | +50 | 2900-3000 | 138.35-140.61 |

Subscriber note: The FOB China prices in the weekly analysis on 1 October will be assessed based on information collated up to 30 September. The FOB China prices in the weekly analysis on 8 October will reflect business conducted on that day. Please click here for the ICIS publishing schedule.

Overview

- Spot talks in Asia limited

- Buyers unlikely to enter the market for rest of September

- Tight vessel space hampers cargo movement

Spot talks were limited in the week in Asia, but buyers surveyed said they have requirements moving forward. Many said it was unlikely for them to enter the spot market in September and saw H2 October as a more likely time to buy cargoes.

In the near term, on the demand side, the impact of Evergrande’s situation has affected sentiments in the market. Products that are directly linked to the construction industry could see demand impacted, but it is still not entirely clear at the moment for titanium dioxide (TiO2).

On the export front, there were also some uncertainties in Asia where countries are in different phases in their fight against the coronavirus. In India, some buyers were undecided between stocking up or keeping inventories low with the festive season approaching, amid uncertainties over the coronavirus situation, even as vaccination rates have increased since May during the last major outbreak.

On the supply front, checks on Chinese plants on their energy consumption can potentially impact run rates and supply. With both supply and demand in China facing uncertainties and Asian demand largely dependent on the individual country’s policy on reopening, many market players are expected to take a more short-term approach in the spot market.

Outlook

- Asian buyers could enter market after China’s Golden Week holiday

- Chinese domestic demand could enter a lull in Q4

- Supply could be impacted by various environmental checks

Prices

There were selling indications at $3,100-3,200/tonne FOB China in the week. One deal was heard at $3,200/tonne FOB China for a 100-200 tonne cargo. Loading was said to be end September and early October. The deal was not considered in the assessment as it was outside the time frame stipulated in the ICIS methodology. Buyers polled were not in the market during the week, but buying indications were at around $3,050/tonne FOB China.

Contract price for Asia

There were no deals heard done. Discussions in certain parts of Asia could potentially drag into H1 October at least as firm talks have not started. One trader said with supply tight, buyers may have to bid quite close to the offer level in order to secure cargoes. Asian Q3 contracts were settled higher

TiO2 market analysis and price trend

https://tio2.info/backup/TiO2-market-analysis-and-price-trend.html