Supply of titanium is expected to remain tight for the next two years

This paper is an AI translation part of

Understanding the current round of titanium dioxide market from the price increase of titanium raw materials–Titanium dioxide industry research & tracking frame serial 4, by DONGXING SECURITIES.

_Click to view the Original paper.

Supply of titanium is expected to remain tight for the next two years

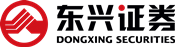

High concentration of titanium raw material manufacturers

Global ilmenite resources are concentrated in Australia, China, India, South Africa and Kenya, These five countries account for 77.50% of the global reserves, China’s titanium reserves account for 26.14% of the global reserves. South Africa, Australia, China, Mozambique and Canada as major suppliers of titanium raw material products worldwide, The total production of titanium raw materials accounts for about 70% of the total global production, China’s production of titanium raw materials (mainly titanium concentrate) accounts for 31% of the world’s total output.

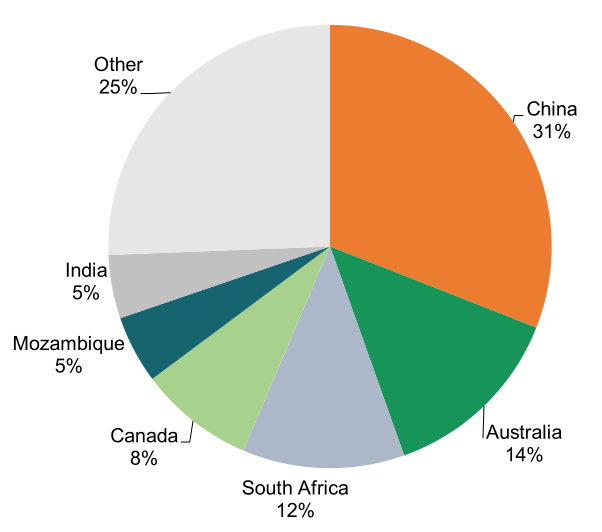

In terms of share, At home and abroad, High concentration, The domestic CR4( Pangang, Dragon python, Anning, Taihe) and overseas CR4(Rio Tinto, Iluka、Tronox、Kenmare) are about 60 percent. Among them high-end titanium raw materials are mainly controlled overseas, Global rutile resources are mainly distributed in Australia, Kenya, South Africa, India, The rutile reserves of the above four countries account for 93.06% of the global reserves. The resources of titanium in China are mainly in the form of ilmenite, In addition, a small amount of titanium resources exist in the form of rutile. According to the National Bureau of Statistics’2017 Statistical Yearbook of China, China’s titanium resources are mainly concentrated in Sichuan, A small amount distributed in Hubei, Shandong and other places, The reserves of titanium resources in Sichuan Province account for 90.40% of the total reserves in China.

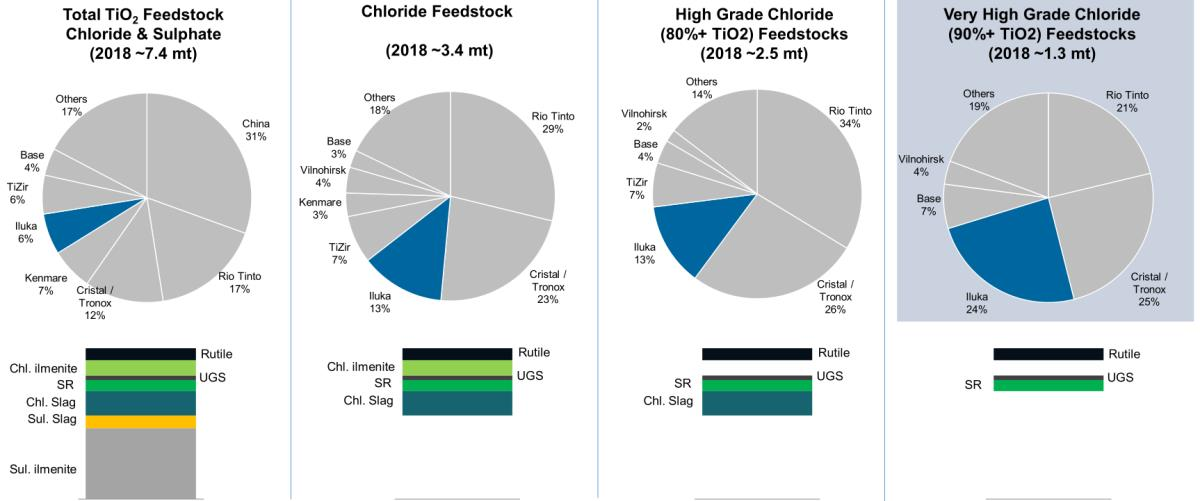

Titanium raw material resources are exhausted, grades are declining, capital expenditures are lacking, and supply will enter a downward turning point in 2020

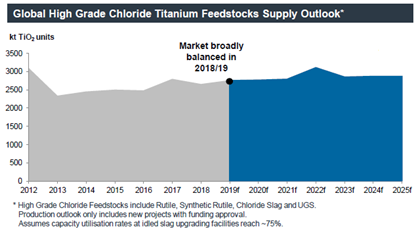

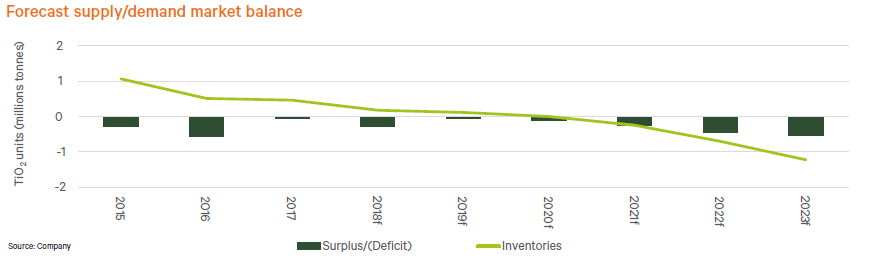

The production and demand of titanium ore will be basically balanced in 2019, and the supply and demand gap will appear from 2020. In the future, the existing mine production will decrease with the decline in reserves and grades. According to Iluka and TZMI, the waste composition of mineral sand resources under exploration continues to increase, while the accumulation of rutile/zircon continues to decline. In terms of production capacity, the supply of titanium ore will shrink in the future, and the unit cost will increase accordingly. Iluka’s unit titanium raw material cost has risen for two consecutive years, and Kenmare also expects the unit cost of titanium raw material to increase from 2019. Rio Tinto also expects the overall supply and demand balance of titanium ore in 2019.

Since then, the overall supply of titanium ore (high-grade + low-grade) has shown a downward trend. The overall demand growth rate for titanium raw materials is expected to be 2.3%. The above analysis shows that Rio Tinto’s judgment on the 2.3% demand growth rate for titanium raw materials is not optimistic.

Iluka expect 2019 to be the critical point of supply and demand for high-grade titanium ores. Based on the expansion advantage of future chlorination method over sulfuric acid method, the annual demand growth rate of high-grade titanium ores in the next five years is about 5%. The production of high-grade chloride raw materials will decrease from 2019, assuming that the capacity utilization ratio of idle titanium slag reaches 75%, and the annual output growth rate of high-grade chloride raw materials in the next five years is only about 1%, which is difficult to meet the demand.

- Note: according to the TZMI forecast, the demand for high grade chloride raw materials will increase by about 5% per year in the next five years; figures 11 and 12 do not include Iluka high grade raw materials items.

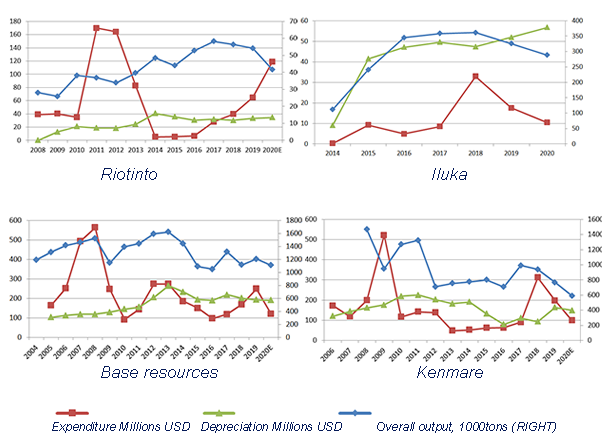

Judging from the capital expenditure of the global titanite leader:

- Since the upward stage H1 titanium dioxide cycle in 2016 H2 2018, the price increase of titanium raw materials is limited, and neither the price nor the profits of related companies have been repaired to the peak level of 2010 2011 cycle, so the capital expenditure of some titanium mining companies has increased at the beginning of 2018, but the overall range is not large;

- Among them, Rio Tinto, Iluka and Kenmare have had more significant capital expenditures since 2018, Others, such as Tino, have little additional capital spending on titanium, The main focus of the company and the integration of the original assets of Koster (the original Terno and Koster each have titanium matching, There is room for optimization from the supply chain (s); And since 2020, Except for Kenmare, the capital expenditure of other companies has fallen sharply, Company conditions vary, Such as Rio Tinto’s previous work due to local violence and the suspension of the epidemic, Iluka large capital expenditure has been cashed in (Cataby production cashed in, Sierra less than expected, completed impairment), Base resources pre-work due to the stagnation of the epidemic (the final investment has not yet been decided);

- Referring to the historical capital expenditure and output relationship of several leading firms, Can be seen that the high output is basically lagging behind the high capital expenditure of 3~6 years or so, Basically corresponding to the mining investment-mining cycle time, Iluka Cataby projects and Sierra projects that started production in 2019, for example, started pre-project work by 2016 and Moma expansion by 2017; Combined with the foregoing analysis, As capital expenditures of several leading companies have been cashed in since 2019(Iluka、Image) or halted for various reasons, including the outbreak, (b) We judge that there is no significant supply increment except Kenmare in the next three years or so;

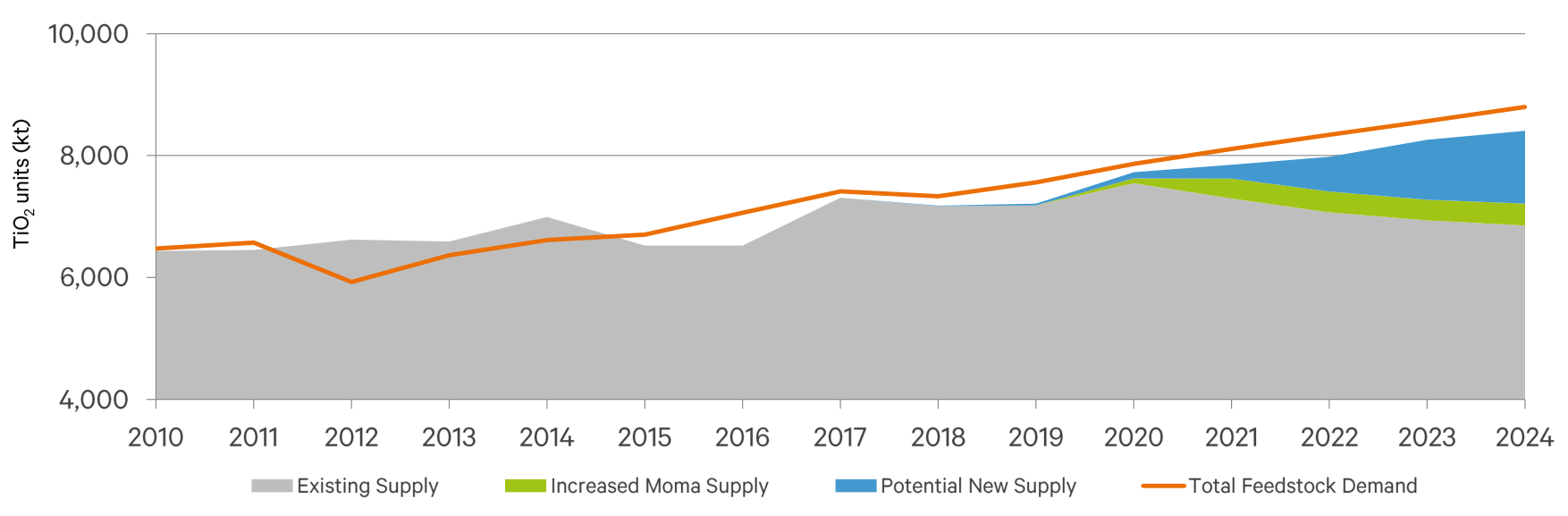

For the next two years, the production increase of 300 thousand tons of titanium high slag, which is basically only Kenmare overseas is determined

Specific follow-up analysis of the recent output and capital expenditure of overseas titanium companies shows that:

- Rio Tinto’s Rio Tinto:Zulti North is declining, with the South Mine only spending on maintenance / alternative capital to compensate for the decline in grade and production in the North Mine, and the company is reassessing its investment of A $463 million due to the impact of the violence from the end of 2019 to the present.

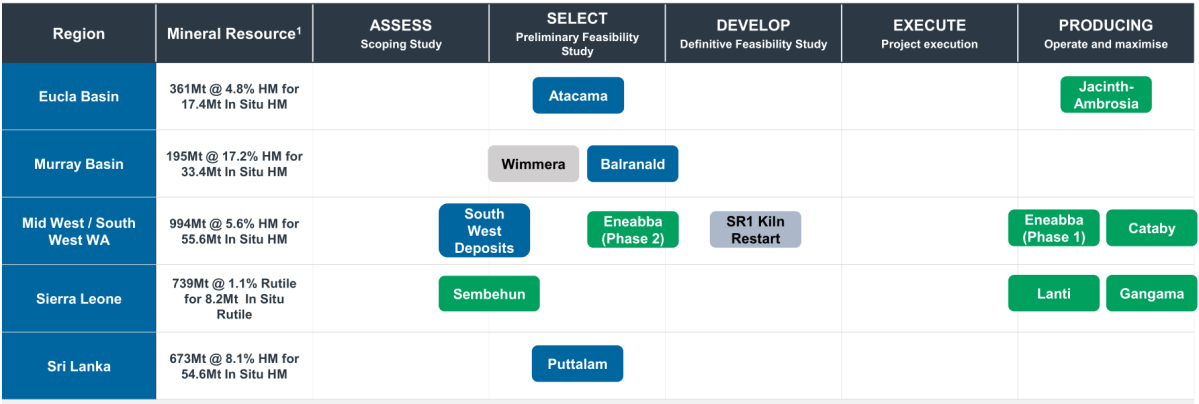

- Iluka:Cataby project is positioned to compensate for the volume reduction caused by the Tutunup closure, which closed in February 2018; The project plans to produce a total of 440000 tons of ilmenite, Of these ,370,000 tons were used for 200,000 tons of synthetic rutile, So the sale of ilmenite is planned for 70,000 tons, Another 30,000 tons of natural rutile, The production of synthetic rutile increased by 111600 tons in the first half of 2020, Basically achieve the project planning objectives; Sierra project investment was unsuccessful, Production was lower than expected, The company made a large amount of impairment in 2019, In terms of corporate guidance, The future will be used only as maintenance capital expenditure; The company’s overall capital expenditure in the first half of 2020 is $50 million, Mainly for Eneabba monazite project, Sembehun(20 to 30 km northwest of the existing Sierra rutile mine operation area), pre-project work (research), Balranald and Nepean project potential assessment, pre-project evaluation (zircon and rare earth), As a result Iluka no significant increase in titanium production is expected in the next three years.

- Note: SR1 project is only 110000 tons of synthetic rutile production, not involving new mining of titanium ilmenite.

- BASE RESOURCES: The feasibility study of the Toliara project was completed at the end of 2019 and is still in the early stage. The final investment decision time was postponed to the second half of 2020. Kwale Phase 1 mining area production reduction, the company mining from the central sand dunes to the south, to make up for the central mining area depletion.

- Kenmare: The company’s capital expenditure in the past two years is mainly Moma projects, gradually put into production ,2019 output of 893000 tons ,2022 target of 1.2 million tons, the next two years year climbing ,12~150000 tons per year.

- Shefield: Thunderbird Thunderbird project, The company announced on June 11,2019, Will delay the construction of the TiFe roasting facility at Thunderbird in western Australia, To give priority to zircon, (a) The announcement in April 2020 that the maintenance and maintenance of the Thunderbird project was formally suspended; Yan Gang announced in August 2020 that it would invest A $130.1 billion to acquire a 50 per cent stake in the project, The funds will be used for the first phase of the Thunderbird project, At the same time, the project export ilmenite ownership, We expect the project to start production in 2023 and beyond.

- Image Resources: Boonanarring project has been put into operation, HMC,240,000 tons planned To 30~330,000 tons HMC, projected The corresponding sub-product upgrade is similar, From December 2019, Mine life is estimated at 6 years; Atlas project is expected to be no less than Boonanarring mining area, Atlas main role, Continue mining after the end of the Boonanarring.

- Tronox: Tronox announced a complete cessation of external sales of rutile at the end of 2018; the mine in former Koster stopped production in October 2018 and resumed in August 2019, but is expected to decline.

- Sibelco: The production of rutile by major producers, such as Sibelco,Iluka, declined after the depletion of resources in the Murray Basin in southeastern Australia; Sibelco mines in Stradbroke Island, Australia, are scheduled to close by 2020 for environmental reasons.

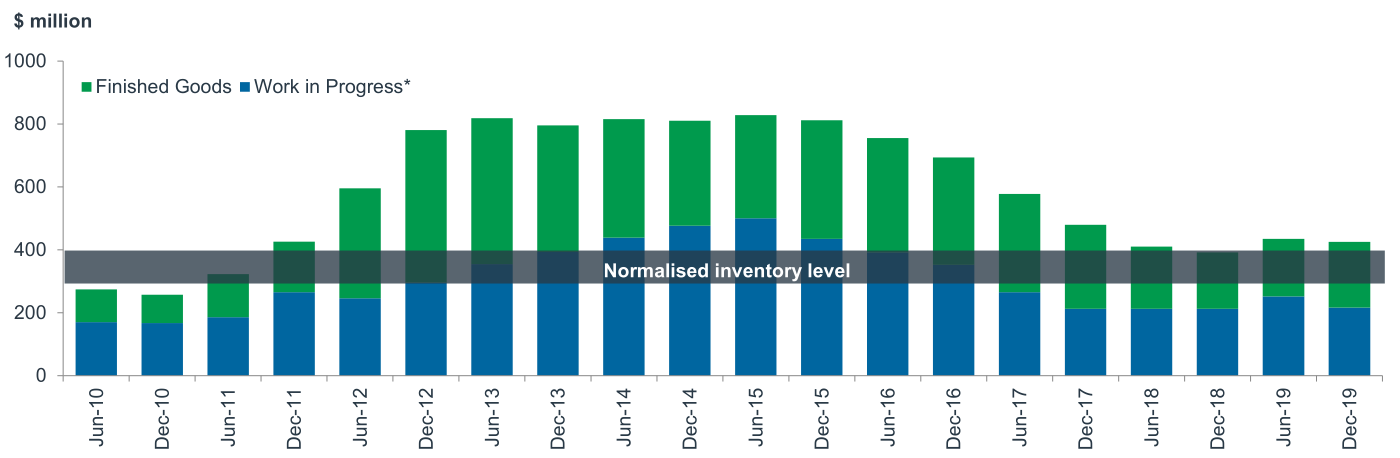

Overall :2019 to date, Although all Ikula、Image、Kenmare have titanium, Iluka two new and Image projects, however, have already had an impact on the market supply, If we look H2-2022 2020, Sheffield、Base titanium projects are expected to release as soon as 2023 due to the impact of the epidemic, The Rio Tinto South Mine, which was expected to start production by the end of 2021, is still suspended in the early stages of local violence and the pandemic, and is mainly used as an alternative capital expenditure for the North Mine, The Australian East Zirconia Atlas program is only an alternative capacity for Boonanarring projects, and Boonanarring still has more than five years of service, Therefore, during 2020 H2-2022 only Kenmare 300000 tons of titanium concentrate production is relatively certain. Therefore, Less than 150000 tons of titanium concentrate per year can only meet the demand of about 60,000 tons of titanium dioxide, Far from 200,000 tons of titanium dioxide a year, And during 2021 2022 due to the existence of replenishment stocks, The apparent demand is expected to be greater than the real demand.

Supply of titanium is expected to remain tight for the next two years

https://tio2.info/2020/11/27/Supply-of-titanium-is-expected-to-remain-tight-for-the-next-two-years/